Commentary by Louis Rodolico

When I voted for the SDSU Mission Valley project I assumed that the land costs indicated on the ballot had been properly analyzed. They have not. The consultant for SDSU took improper deductions. Normally a lot is purchased and the developer comes to the city for a permit and a development impact fee assessment. These fees are paid by the developer for the city to put in the roads, sewers and other infrastructure that the developers design will need. However SDSU’s consultant took their inflated impact fee assessments and deducted them from the land cost. This is not how things are done. By doing this the consultant dropped the land cost from 508 million to 86 million or 14.8% of the land value.

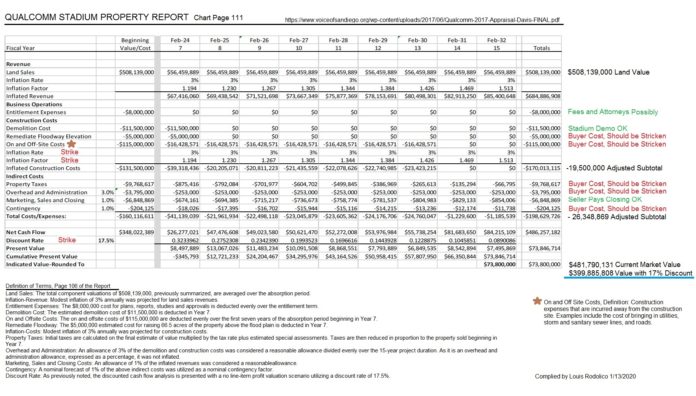

Attached is a spread sheet that shows the fair market value of the land at $508,139,000 and the manner by which SDSU lowered it.

The ballot said the land would be sold to SDSU at “fair market value” 14.8% of land value is not fair market. I could find 26 million in legitimate deductions like the 10 million for stadium demolition.

This November we should give voters the opportunity to be generous and vote on a SDSU 17% discount which would bring the land cost to about 400 million.